System Features

1.1 Overview of System Developments

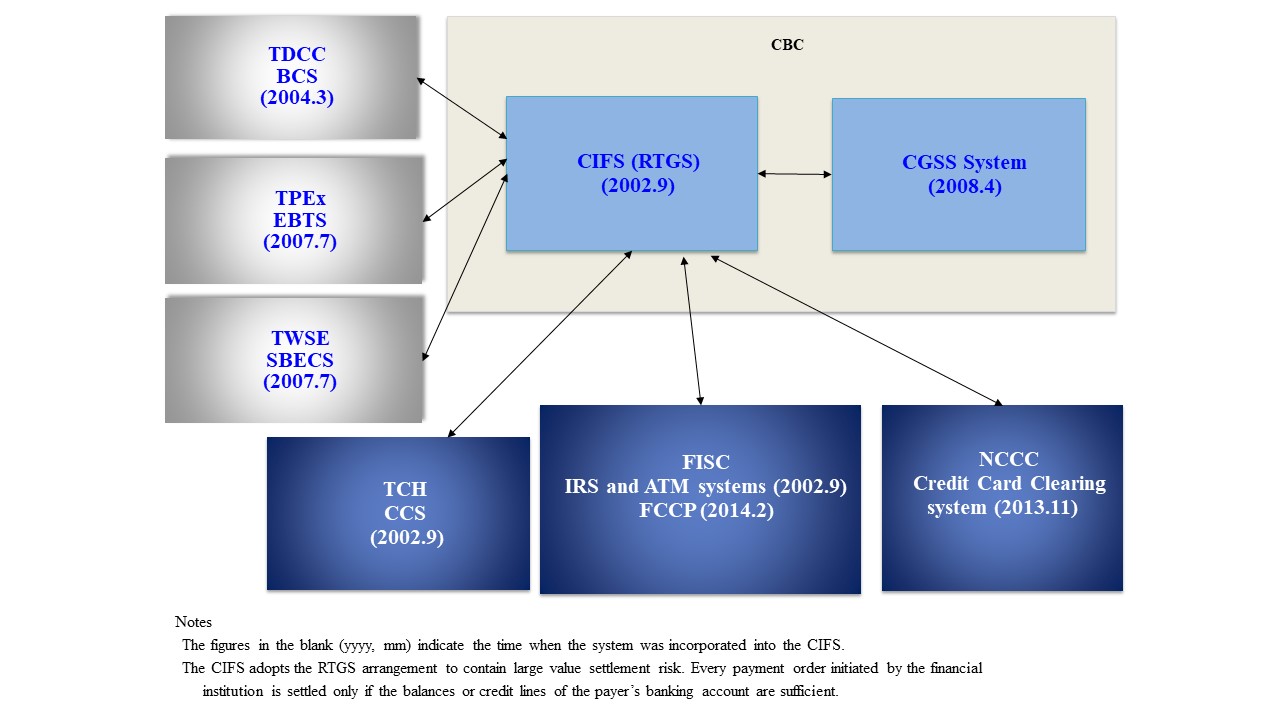

The CBC Interbank Funds Transfer System (CIFS), established and operated by the CBC, is a large-value electronic payment system which serves as the hub of domestic payment and settlement systems (See Chart 1).

To ensure the safety and efficiency of large-value settlements, the CBC has progressively introduced the following reforms to construct an integrated payment and settlement system and maintain sound functioning of the financial payment systems.

(1) From May 1995, manual funds transfer operations were replaced with electronic funds transfer process.

(2) In September 2002, the CIFS was comprehensively transformed into the Real-Time Gross Settlement (RTGS) mechanism to contain large-value settlement risk. In addition, the CIFS started to connect with the Check Clearing System (CCS) of the Taiwan Clearing House (TCH) to settle interbank funds from checks clearing, and with the Financial Information System (FIS) of the Financial Information Service Co., Ltd. (FISC) to settle interbank funds from interbank remittances and interbank ATM withdrawals and transfers.

(3) From September 2002, in supplement to the implementation of the RTGS, the CBC started to provide intraday overdrafts. CIFS participants shall pledge full amounts of eligible collaterals to obtain intraday liquidity provided by the CBC.

(4) In April 2004, payments for the settlements of bills transactions were incorporated into the CIFS and processed through a delivery-versus-payment (DVP) mode to reduce settlement risk.

(5) In July 2007, payments for the settlements of stock and bond transactions were incorporated into the CIFS to decrease settlement risk.

(6) In April 2008, payments for the settlements of domestic government bonds were incorporated into the CIFS and settled through the DVP mode to improve delivery efficiency and reduce settlement risk.

(7) In November 2013, the accrued payables and receivables among banks cleared by the National Credit Card Center of R.O.C. (NCCC) were incorporated into the CIFS to improve settlement efficiency of credit cards.

(8) From February 2014, the CIFS linked with the Foreign Currency Clearing Platform (FCCP) to settle USD-NTD swap transactions with the adoption of a payment-versus-payment (PVP) mechanism. Furthermore, the function of the FCCP was expanded gradually to incorporate PVP settlements of foreign exchange swap transactions between the NT dollar and other foreign currencies including the renminbi, Japanese yen, the euro and the Australian dollar.

The above developments all comply with related payment and settlement principles published by the Bank for International Settlements (BIS) to ensure safe and efficient operations of payment systems. (For more details, please refer to the PFMI Disclosure Report on the CIFS in the section of Payment and Settlement Systems Reports.)

1.2. Providing Settlement Services for Payments

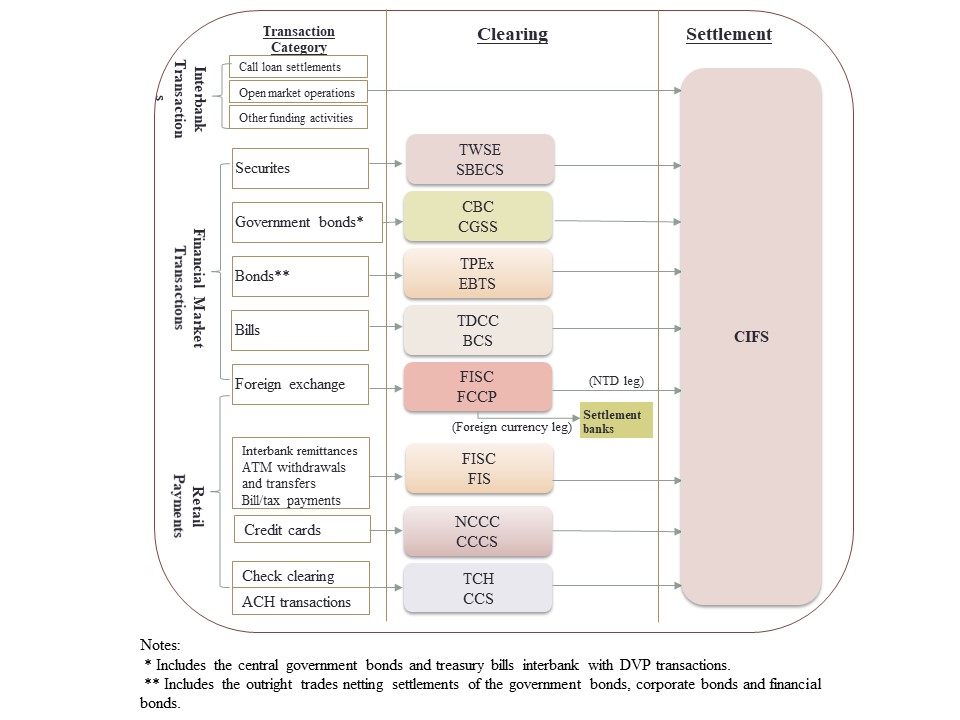

The CIFS operates from 9:00 a.m. to 5:40 p.m., providing interbank large-value settlement services, including interbank funding, reserves requirement adjustments, call loans, and other interbank funds settlements in financial markets, such as transactions of securities, government bonds, corporate bonds, financial bonds, bills, as well as foreign exchange (See Chart 2).

In addition, the CIFS also connects with important retail payment systems to settle interbank remittances, ATM withdrawals and transfers, bill and tax payments, credit card transactions, check clearing, and ACH payables and receivables, etc. (See Chart 2).

1.3. CIFS Participants

Currently, there are 85 institutions participating in the CIFS, including 39 domestic banks, Chungwa Post, 31 local branches of foreign banks, 8 bills finance corporations, and 6 clearing institutions (See the attached table).

1.4. Clearing Systems

(1) Financial Information System (FIS) and Foreign Currency Clearing Platform (FCCP)—operated by the Financial Information Service Co., Ltd. (FISC). (https://www.fisc.com.tw)

(2) Check Clearing System (CCS)—operated by the Taiwan Clearing House (TCH). (https://www.twnch.org.tw)

(3) Credit Card Clearing System (CCCS)—operated by the National Credit Card Center of R.O.C. (NCCC). (https://www.nccc.com.tw)

(4) Bills Clearing System (BCS)—operated by the Taiwan Depository and Clearing Corporation (TDCC). (https://www.tdcc.com.tw)

(5) Securities Book-Entry Clearing System (SBECS)—operated by the Taiwan Stock Exchange Corporation (TWSE). (https://www.twse.com.tw/zh/)

(6) Electronic Bond Trading System (EBTS)—operated by the Taipei Exchange (TPEx). (https://www.tpex.org.tw/web/)

(7) Central Government Securities Settlement System (CGSS)—operated by the CBC. (https://www.cbc.gov.tw/en/cp-860-34726-2EE01-2.html)

* Includes DVP settlements for interbank transactions of central government bonds and treasury bills.

** Includes netting settlements for outright trades of government bonds, corporate bonds, and financial bonds.